If you have a high deductible insurance plan, your employer may also offer a Health Savings Account. An HSA is like a savings account but for medical expenses. You can use the funds to pay for eligible healthcare expenses, including the dreaded out-of-pocket expenses your insurance doesn’t cover or to meet your deductible.

If you’re thinking ‘not another deduction from my paycheck,’ read on to learn the five reasons to take advantage of a Health Savings Account.

1. The Triple Tax Advantage

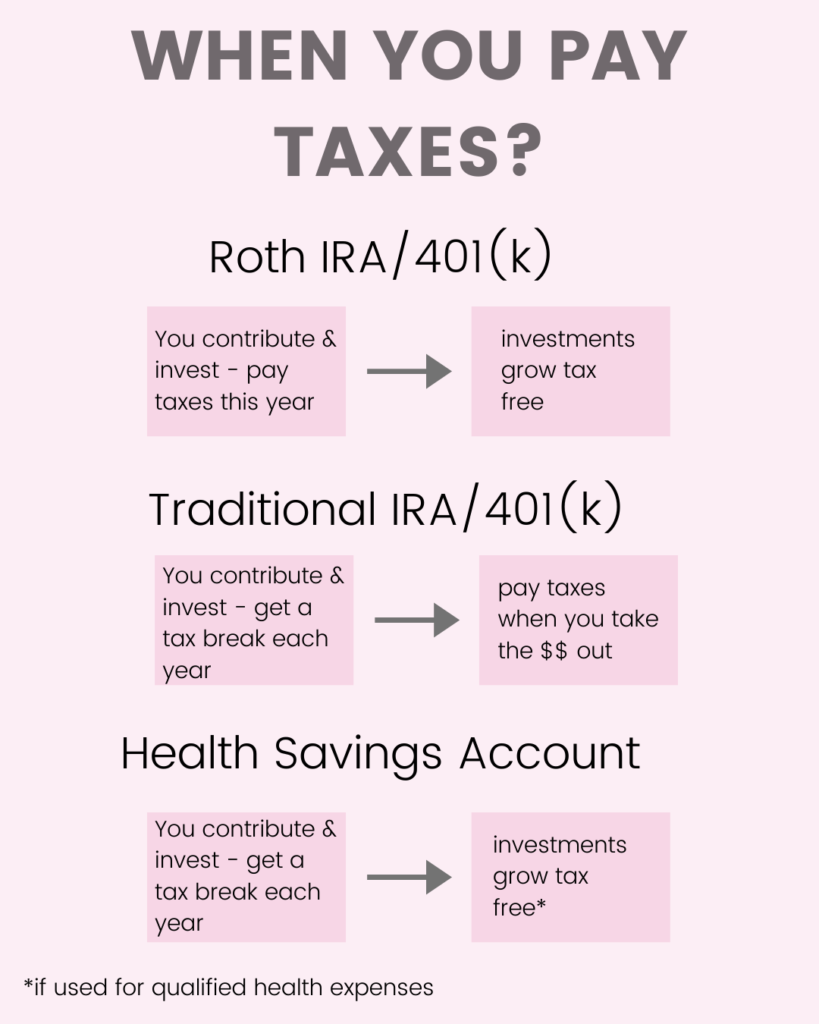

Although “Health Savings Account” includes the word “Savings” it actually can double as an investment account. The Health Savings Account is tax-advantaged, sort of like your 401K or IRA accounts.

But, it’s even better! With a 401K or IRA you will have one tax advantage. So, you can invest in a tax-deferred account and save now or use a tax-exempt account and save later. But with an HSA, you can invest pre-tax dollars and your money grows tax free. This is what some people like to call a triple tax advantage (or a triple threat..of retirement accounts that is).

Here’s how it works:

- Your contributions are pre-tax.

- This decreases your tax liability today and makes the money you put aside for healthcare costs go further. That means, that you reduce your taxable income for the year by taking advantage of your HSA.

- Your earnings grow tax-free.

- You invest your money how you want and pay no taxes on the gains. Unlike a brokerage account or pre-tax retirement account, as long as you use your HSA for health related qualified expenses,

- You invest your money how you want and pay no taxes on the gains. Unlike a brokerage account or pre-tax retirement account, as long as you use your HSA for health related qualified expenses,

- Your withdrawals are tax-free IF you use them for eligible medical expenses.

- If you spend your HSA on health expenses after the age of 65, you won’t be hit with a tax bill when you withdraw

- If you spend your HSA on non-health expenses after the age of 65, you will have to pay taxes similar to a pre-tax retirement account

2. You Choose How to Invest It

You can invest your HSA funds how you want. Your only limits are the investments your sponsor offers. Stocks, bonds, mutual funds, and ETFs are all viable options. This is great for those who are relatively healthy now but want to build up a reserve fund for medical expenses as they age.

If you work for yourself and buy your own High Deductible Health Plan, you can choose the HSA custodian, shopping around for the one that offers investments that interest you.

Investing in your HSA will work similar to investing in your IRA or Brokerage account but you will likely be limited to the investments offered, but it will vary by HSA provider.

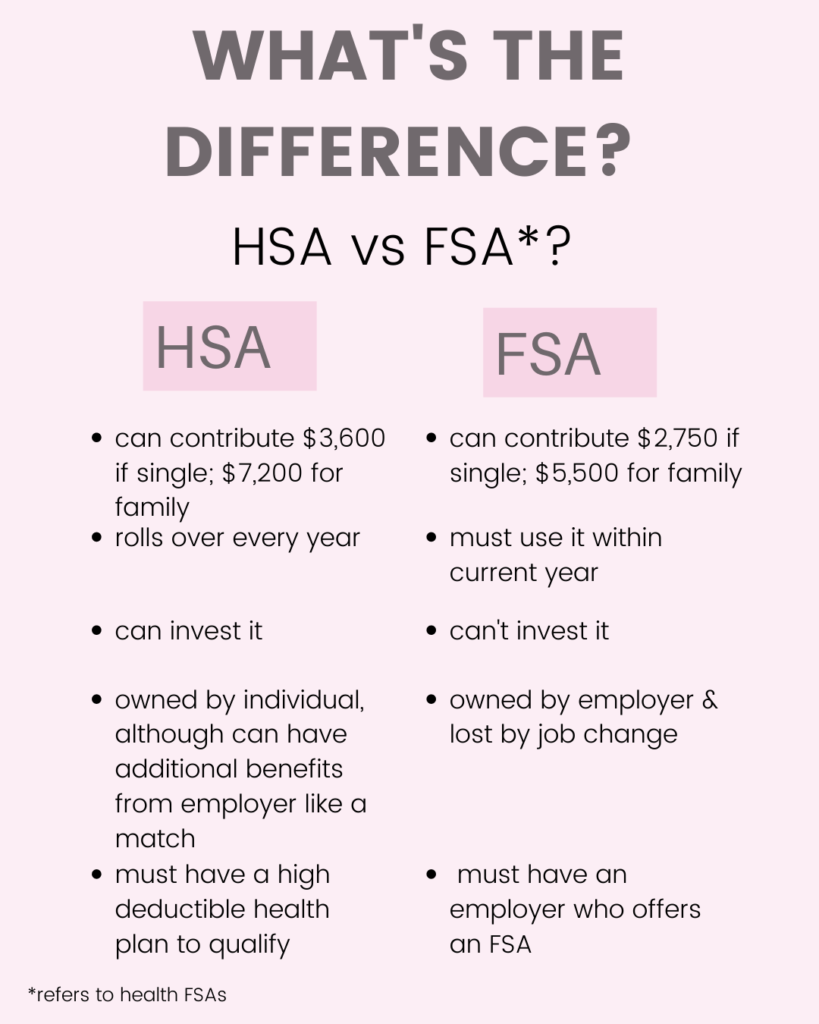

3. Health Savings Accounts Don't Expire

Unlike FSA accounts, you don’t have to worry about using your funds or losing them. HSA funds roll over each year. This means you can save the funds for large medical expenses if you wish rather than using them throughout the year for smaller, routine expenses.

You can change jobs, change insurance plans, or even retire and the funds remain in the account for you to use for any eligible healthcare expenses.

4. A Health Savings Account can be another Retirement Account

HSA accounts are meant for healthcare-related expenses, but once you retire, you can use the funds for any purpose without penalty. Before you turn 65, if you withdraw funds for anything besides healthcare expenses, you’ll pay a 20% penalty plus taxes. After age 65, you can withdraw them. If you use them for anything besides healthcare expenses, you’ll just pay the income tax on the funds.

If you are like me and want to retire early, here’s my plan for using my HSA to retire early.

Pay for current medical expenses out of pocket

I want to take advantage of compound interest for as long as I can on my HSA investments so I am funding my health care expenses out of pocket that doesn’t get covered by insurance. As I am younger, my health related expenses are relatively lower, but I assume as I get older this will get more expensive.

Contribute the maximum every year

As someone filing taxes single, I am eligible to contribute up to $3,600 annually into my HSA account in total. As an incentive to use it, my employer matches $400 per year so I can contribute up to $3,200 and get $400 added to my account free.

Invest in low cost index funds

Within my HSA, I keep a consistent strategy of investing in low cost index funds. My HSA provider gives me the option to invest in Vanguard’s mutual funds so I select a Total Stock Market Index Fund with an expense ratio of 0.04%. This allows me to avoid losing too much of my investment growth too fees and take advantage of as much compound interest as I can.

Use my HSA penalty free after age 65

After the age of 65, you can withdraw from your Health Savings Account penalty free. On average, it will cost you anywhere from $100,000 to $300,000+ on health related expenses in retirement. This will depend on a number of factors but most closely tied to how healthy you are personally. Given this, I don’t think I will have an issue spending my HSA funds on health care expenses. However, if I do decide to use this money on non-health related expenses, I would not have to pay any penalties after the age of 65 and I will just be subject to my income tax rate at that point in time.

5. You can Use an HSA to Pay for Loved Ones’ Medical Expenses

You can use the funds in your HSA to cover the medical expenses of anyone you claim on your tax return. This includes your spouse and children, as long as they don’t receive reimbursement from any other sources.

When you “gift” an HSA contribution to a family member, you can claim the contribution on your taxes.

The bottom line..

Therefore, if you have a high deductible insurance plan or you’re thinking of switching over to one, pair up an HSA with it for the greatest savings. In conclusion, you’ll not only save money on your premiums with the higher deductible, but any money you contribute to your HSA will grow tax-free, giving you even more use out of your money.

Health Savings Accounts (HSA) Frequently Asked Questions

What is a Health Savings Account?

A Health Savings Account or HSA is a tax advantaged savings and investment tool for qualified health expenses.

Who is Eligible for a HSA?

In order to be eligible to contribute to a health savings account, you must be enrolled in a high deductible health plan (HDHP). If you are unsure whether or not you qualify, please reach out to your health plan provider for confirmation.

What are the contribution limits and guidelines?

As of 2021, if you are filing taxes single, you may contribute up to $3,600 in your HSA. If you are filing as a family, you may contribute up to a total of $7,200 to your HSA.

What is considered a qualified health expense?

There are a long range of qualified health expenses from medications to dental work to feminine products. You can find the full list here.