Did you know that a low credit score can cost you over a $100,000 just from additional interest on your mortgage?

At some point in life, you may want to borrow money to buy a car, refinance a mortgage or apply for credit of some type.

Lenders need to know how likely (or unlikely) you are to pay back a loan on time.

They will use your credit score to determine:

- Whether to lend to you

- How much money they can lend you

- How much interest to charge you

A higher credit score could improve your chances of getting better terms and lower interest rates on the best financial products.

So it’s advisable to improve your credit score and make it the best it can be. In this article, I will walk you through five strategies you can use to grow your credit score.

How Your Credit Score Is Determined

Before we get into how to grow your score, it is important to know how it is determined. Companies use figures in your credit report to create your credit score. The 3 major credit reporting agencies are Equifax, Experian and TransUnion.

Most lenders typically use FICO score, a 3-digit number based on the information in your credit reports

A few factors come into play when creating your score.

They include inquiries (how often you’re applying for new credit), your payment history, your length of credit history, your credit utilization ratio (how much credit you use vs. your credit limit) and your credit mix (installment vs. revolving credit).

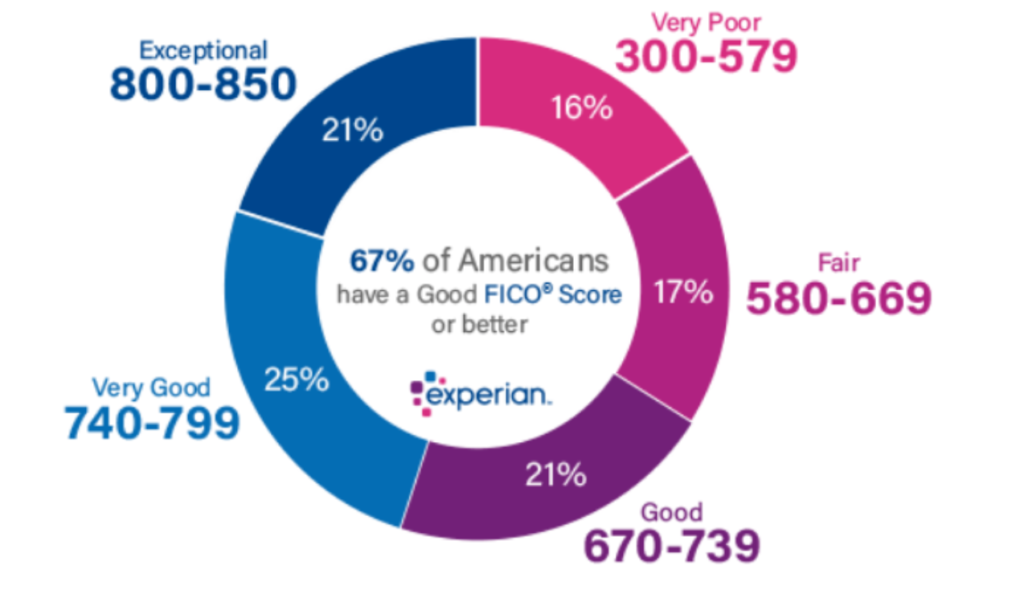

Based on these factors, your FICO score can range from 300-850.

300 – 579 Very poor

580 – 669 Fair

670 – 739 Good

740 – 799 Very good

800 – 850 Exceptional

Source: Experian

What Can I Do to Increase My Credit Score?

If you’re looking for a quick way to improve your credit score, I should mention that there’s no single method that will magically raise your score overnight. This is because your credit score is complex and consists of several interconnected factors.

The good news is that there are steps you can follow to boost your standings in a relatively short period.

Depending on your situation, here are 5 ways to way to increase your credit score:

1. On Time Payments

First and foremost, Lenders are very interested in how reliably you pay your bills. Past payment performance is commonly considered a good predictor of future performance.

Missing credit card payments can cause your score to decline fast, as it tells lenders that you struggle to manage your credit well. Late payments can remain on your credit report for up to 7 years.

Setting up autopay will ensure that you’ll never forget to make a bill or credit card payment.

Autopay could also help you build a consistent payment history over time.

Showing that you can reliably pay back any money you borrow makes you appear more attractive to lenders.

2. Increase Your Credit Limit

A credit limit refers to the maximum amount your credit card issuer allows you to charge on a single credit account.

Asking for a higher limit from your card issuer is another way to improve your score.

It’s worth mentioning that when you request a credit limit increase, some issuers perform a hard credit check and leave a mark on your credit report, which can cause your credit to dip.

Here’s how to ask for a credit limit increase the right way.

Pro tip: Be cautious with this method if you tend to have problems with overspending.

3. Reduce Your Utilization Ratio

Next, lowering your credit utilization ratio can also help to raise your credit score.

Avoid the temptation of using too much of your available credit.

So what’s the ideal credit utilization rate? Well, this may vary depending on the lender’s preferred scoring system. As a rule of thumb, aim to keep your utilization under 30 percent of your limit.

Let’s say you have a credit card with a $500 spending limit. You can spend $150 or less. If you spend more than $150, that hurts your credit.

A low credit utilization ratio shows lenders that you can manage your credit sensibly.

4. Avoid Opening Too Many Cards

Next, applying for multiple new credit cards in a short space of time to lower your credit utilization could make you look like a risky borrower.

So try to resist the temptation to apply multiple times if you’re rejected for credit.

If you already have too many credit cards, consider consolidating your debt into one balance transfer card. Debt consolidation will make it easier to manage your monthly payments.

A lower interest rate can also help to accelerate paying off your balance. This is because instead of interest, more of your payment can be applied to your principal balance.

Lower balances = lower credit utilization ratio (and an increase in your score).

5. Dispute Errors on Your Credit Report

Finally, the information held in your credit report determines your credit score. If this info is inaccurate, then your credit score won’t be either. Unfortunately, this could translate to a lower credit score.

According to a Federal Trade Commission (FTC) study, 1 out of 5 Americans have an error on their credit report. And 1 out of 10 have an error that might lower their credit score.

You have the right to a correct credit report under the Fair Credit Reporting Act. Regularly checking your credit report can help you spot (and fix) any mistakes and boost your credit score.

To Wrap Up

In conclusion, increasing your credit scores takes time, and by employing the above tactics, you can do it by yourself.

Have you tried increasing your credit score? Which method/s did you use? Keep the conversation going in the comments section below.